how to become a tax accountant in canada

Each advanced Tax Accountant position requires approximately 2 years of experience at each level to advance in your Tax Accountant career path. The merging cost accounting with analysis skills and financial planning increasing complexity and changes.

Canadian Cpas Seeking The U S Cpa Credential

Therefore the ability to.

. Advance in Your Tax Accountant Career. Preparing federal and state tax returns. Determining your career path is often the next step to becoming an accountant.

This article explores who a tax preparer is what. You can choose to specialize in a specific field of. Business Administration with a focus in.

Choose Your Career Path. Begin the process of becoming a tax accountant by pursuing a bachelors degree. Thinking of becoming a Chartered Professional Accountant CPA.

The most successful personal tax consultants are those who keep learning about different aspects of taxation. As a tax preparer you will be dealing with a long list of taxes which you have to deal with to maximize deductions. The Chartered Professional Accountant CPA.

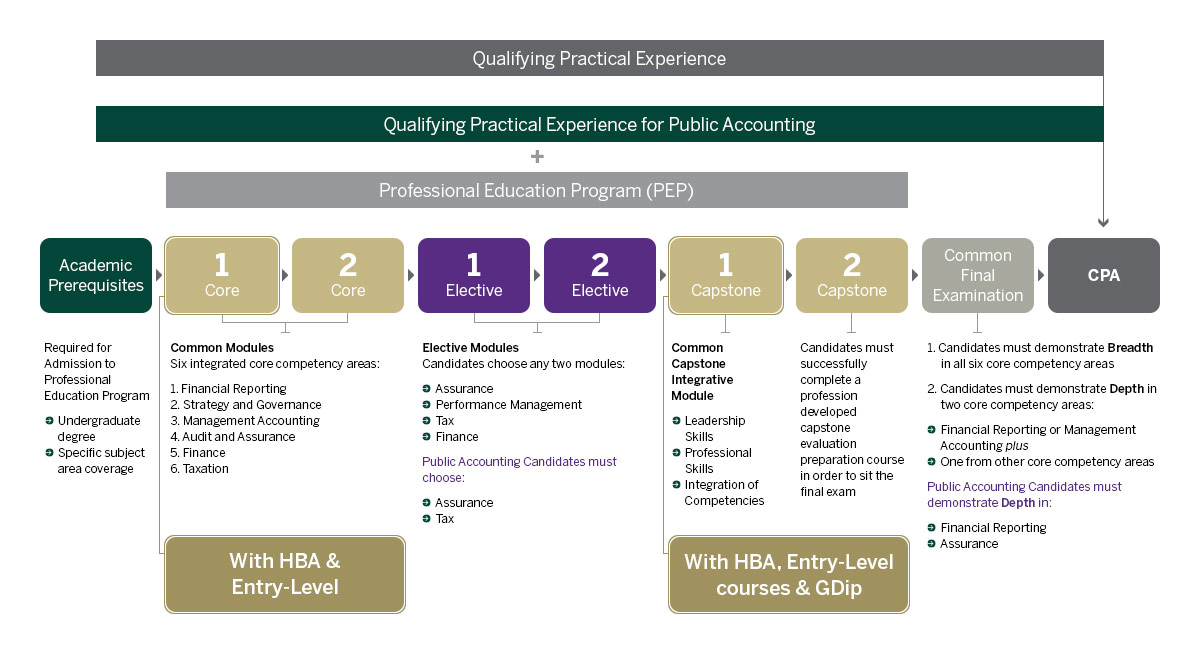

Obtain an undergraduate degree from any recognized university in Canada. Different pathways can qualify you to become a CPA in Canada and take the CPA Professional Education Program PEP but the default route includes. O Relevant Fact 1.

It may be necessary to receive additional. Filing tax documents on a clients behalf. As a tax professional your regular tasks and responsibilities might include.

If you already have an undergraduate degree with an accounting focus then follow this default route to become a CPA in Canada. Gain practical and professional experience. To become a tax accountant individuals need to develop professional skills study for relevant qualifications and gain invaluable work experience within the industry.

To become a tax accountant you typically need at least an undergraduate degree in one of the following fields. O Relevant Fact 2. Accounting continues to have strong employment and earning potential in Canada.

Studying in an recognised university is necessary to become a Chartered Accountant. Do your own taxes starting with the first year you earn income to help learn the process from the ground up. However this may not be.

Choose a Specialty in Your Field. The next step to becoming a professional chartered accountant after obtaining a bachelors degree is to gain professional and practical. Having a degree in accounting is not required to.

Offering tax planning advice. Tax Accountant Tips. Consulting with clients to help them prepare for tax season over the year.

Find everything you need to know on the benefits of becoming a CPA and the many paths you can take. Upon successful completion of the CPA Professional Education program you will. Get an Entry-Level Position as a Tax Accountant.

A tax accountant helps individuals and businesses prepare and file tax returns. The responsibilities of a tax accountant include. Here are the steps to follow for how to become a tax accountant.

Continued Education for Your Tax. YOu will need a bachelors degree to become an accountant in Canada. If qualified you will be admitted to the CPA PEP.

How To Find The Best C P A Or Tax Accountant Near You The New York Times

Personal Tax Return Service By Experienced Chartered Professional Accountants Tax Doctors Canada

Coronavirus Resources For Tax Accounting Professionals Wolters Kluwer

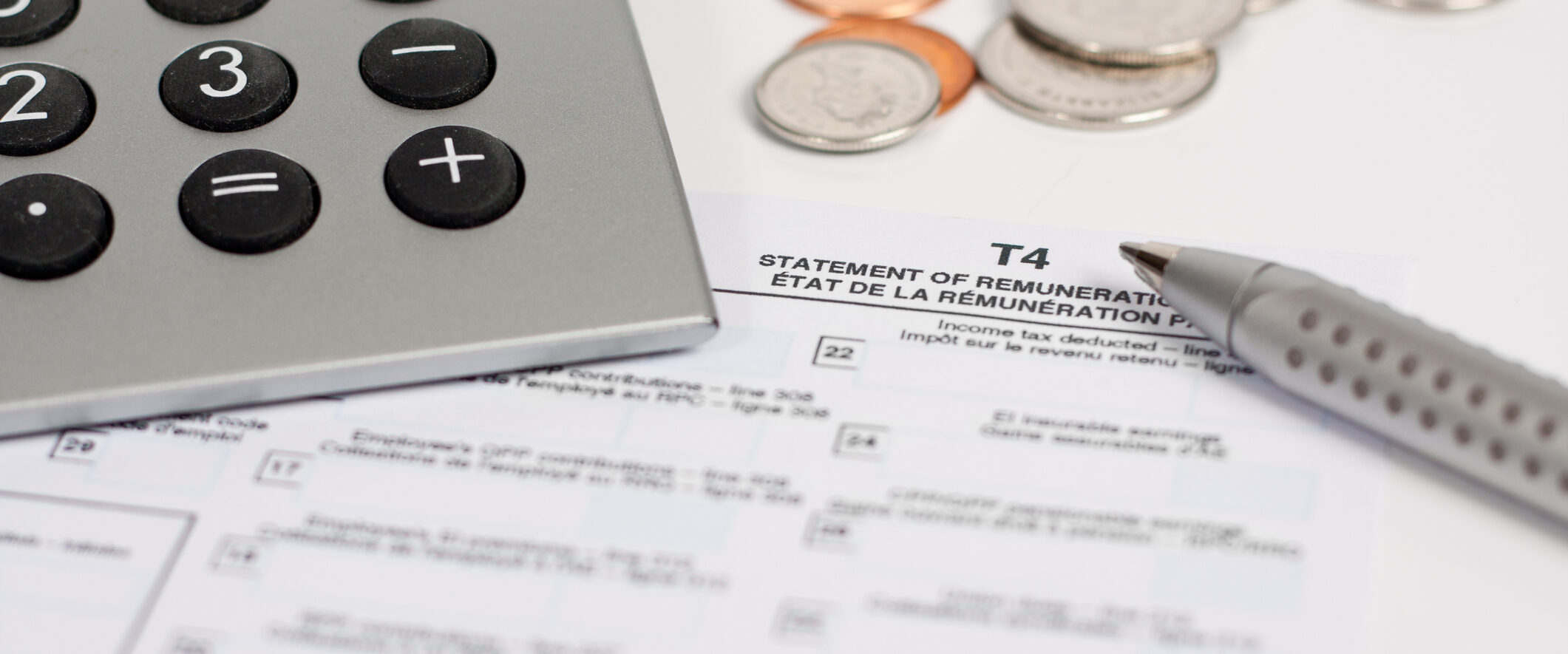

T4 Slips What Canadian Employees Should Know Nerdwallet Canada

Senior Tax Accountant Resume Example Fox Corporation Belmont Massachusetts

A Guide To Entry Level Accounting Jobs Robert Half

Tax Accounting U S Hub Wolters Kluwer

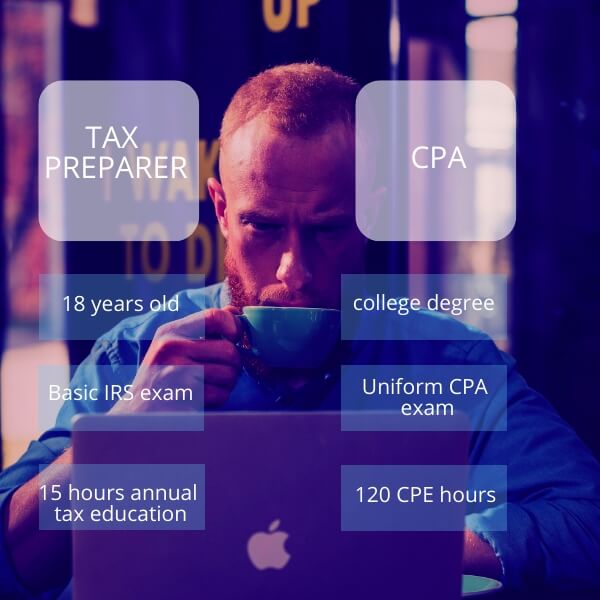

Cpa Versus Tax Preparer What S The Difference Gamburgcpa

Hba Your Stepping Stone To A Cpa Designation The Cpa Ivey Centre For Accounting The Public Interest

Wiley Cpa Career Guide Average Cpa Salary Wiley

Working As An Accountant In Canada In 2022

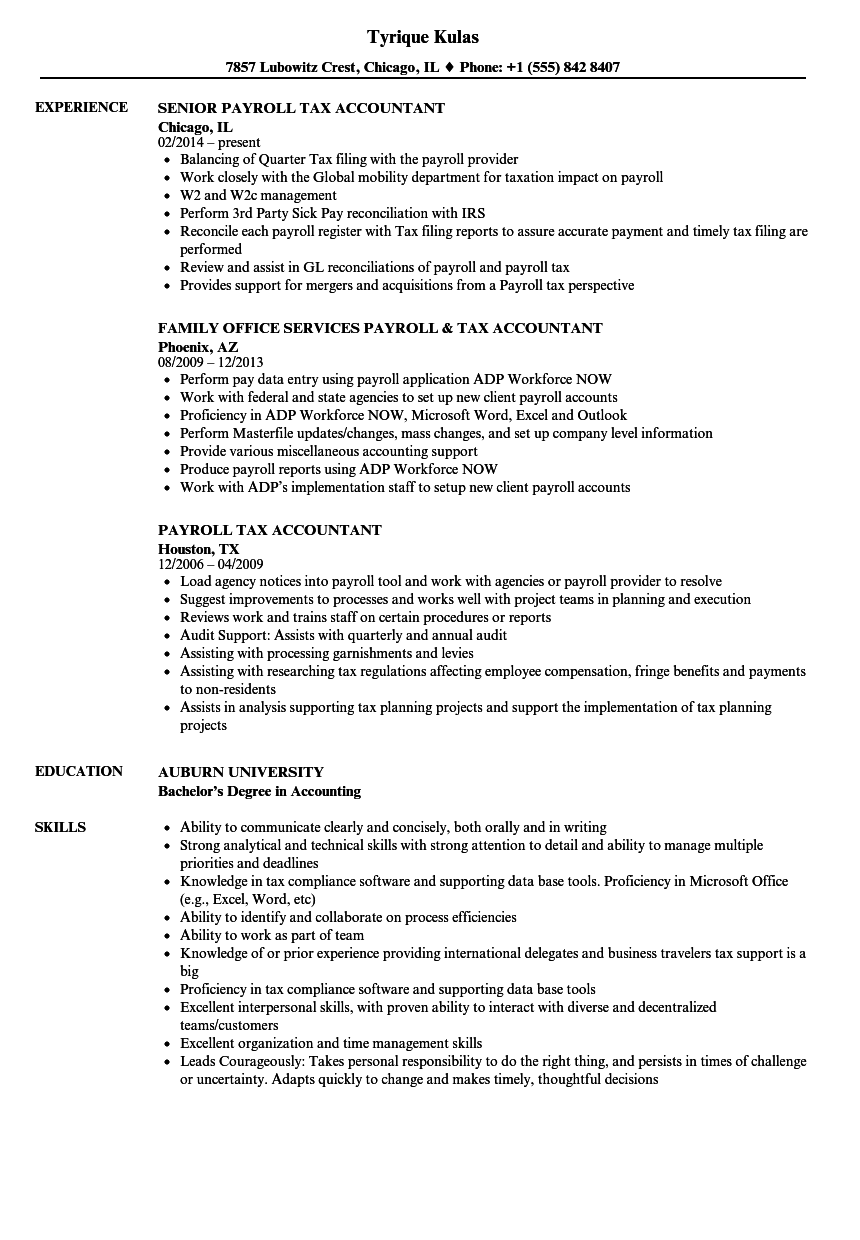

Payroll Tax Accountant Resume Samples Velvet Jobs

What You Need To Provide To Your Tax Preparer 2022 Turbotax Canada Tips

Accountant Connect Accounting Software Adp

Tax Preparer Certification Accounting Com

Tax Accountant Resume Samples Qwikresume

:max_bytes(150000):strip_icc()/young-female-artist-in-studio-working-on-laptop-539434611-5a4e8a5b842b170037c8b2ca.jpg)

How To Prepare Taxes For Your Accountant

7 Skills Cpas Need And How To Get Them Robert Half

Tax Accountant Career Overview Job Description Education Requirements